Any profit including a rental payments received by private landlord from a tenant is the subject to Income Tax. Tax rate on payments getting from a tenant depends on several conditions:

- personal allowance is considered to be a non-taxable minimum amount. Standard personal allowance for 2016-2017 tax year is £11,000, but it may be higher if landlord have additional allowances such as Marriage(transfer £1,100 of Personal Allowance from your spouse who earn higher then £11,000 and you earn lower than this amount) or Marriage Couple(for those who was born before 6 April 1935) or Blind Person allowance, or smaller allowance if total annual income exceeds £100k(no allowances)

- if the landlord's annual rental income is less than £2500

Landlord must notify HMRC and register self-assessment(for private landlord who is self-employed or partnership, not a company) about getting income from rental business till the 5th October of current tax year.

Deadline to complete Tax Return:

- in paper form(SA100) 31 October of the next year following the end of tax year. For instance, for 2016-2017 tax year deadline is 31 October 2017.

- online – 31 January of the next year following the end of tax year.

Deadline for paying tax on rental income:

- 1st payment into account – 31 January of the next year following the end of tax year

- 2nd payment into account – 31 July of the next year following the end of tax year

If landlord just have started a rental business then 1st payment made by 31 January will the equal the tax for the full previous tax year PLUS half of income tax for next tax year, which usually considered to be the tax projection for the next year. The amount paying 31 January and 31 July namely payments on account are based on the previous years earnings. If landlord feels that his income for the next tax year has plummeted then tax payments can be reduce to better reflect the earnings by stated this reduced income into tax return and filing form SA303.

Possible penalties for landlords

Landlord has a risk to be charged for non-compliance with deadline, such as:

- late tax return up to 3 months - £100

- late tax return filing more than 3 months is risk to be charged £10 for each day of delay

- late tax return filing more than 6-13 month may caused charges 5% of tax or £300

Penalties for tax failure or delay is 5% of outstanding tax bill, but not exceeded 70% of tax due.

How landlord may deduct his tax?

Landlord may decrease the payable tax by claiming letting expenses(Income Tax relief’s). There are limited list of expenditures that may deduct a tax even if this expenses are directly related with a property. There are two type of expenses:

- revenue expenses which related directly with day-to day maintenance of rental property and deemed to be essential to the performing landlord’s duties. This expenditures don’t increase the value of property

- capital expenses, that increase a rental property value such as renovation or property improvements

It is obvious that capital expenses are not allowed to be claimed as tax relief of income from rental business.

List of allowable expenses for rental business:

- home and content insurance fee

- letting’s agent and accountant’s fee

- service charges incurred by the ground rent, cleaning and gardening services, gas safety inspection

- amount spent on maintenance such as boiler repairs, plumbers or electrical fee. Renovation or any home alteration or building works such as conservatory, paving, decking are not allowed for landlord’s tax relief

- any cost incurred by advertising property or placing it on a market

- mortgage interest

Till April 2016 landlord may claim 10% of rental income of the “wear and tear” even if no improvements haven’t been made. Now this “tear and wear” allowance was removed. Thus, landlord may deduct a tax on actual incurred and proven expenses.

New changes affecting landlord tax relief

How calculated Income tax before 2017:

All private individual landlords deducted mortgage interest’s costs namely financial costs together with other expenses from the total rental income. Then resulted profit was a subject of marginal tax rate(basic tax rate 20% or higher tax rate 40% that depends on total landlord income)

Source data:

1. Rental income – summary rental payment coming from tenants

2. Other landlord’s income, such as salary and etc.

3. Allowable expenses incurred rental business

4. Mortgage Interest

Income tax =

[(Rental Income + Other Landlord’s Income) – (Allowable Expences+Mortage Interest) – Personal Allowance] x 20%(for basic rate thresholde)

+ Income exceeding basic rate threshold x 40%**

**check tax rate, threashold and income limit for Personal Allowance at HMRC

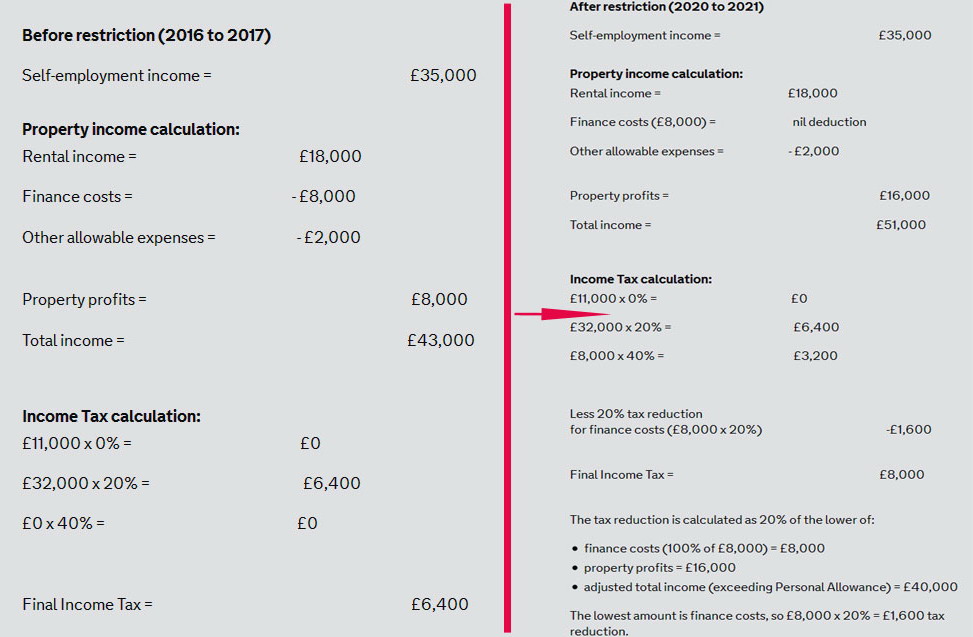

The next picture based on HMRC case studies demonstrates how income tax is calculated before 2017 and after 2020. It is obvious that new legislation wouldn’t increase the tax payable by about 83% landlords in UK which earn in the scope of basic rate threashold:

Then next picture shows mortgage cost affects the taxable profit according the new legislation:

Then next picture shows mortgage cost affects the taxable profit according the new legislation:

After April 2017 till April 2020(transition period)

In this period in each tax year landlord will be allowed to deduct total rental income on just part of mortgage interest’s cost:

- 2017-2018 tax year – 75% of financial costs are allowed for deduction

- 2018-2019 tax year – 50% of financial costs are allowed for deduction

- 2019-2020 tax year – 25% of financial costs are allowed for deduction

- 2020-2021 tax year – 0% of financial costs are allowed for deduction

The remaining financial costs (25% in 2017, 50% in 2018-2019 and 75% in 2019-2029) will be a subject for 20% of tax reduction:

Income tax =

[(Rental income + Other landlord’s income) – (Allowable Expences +Mortage Interest*25%) – Personal Allowance] x 20%(for basic rate threshold)

+ Income (for higher rate threshold)x 40%

Final Income TAX =

Income Tax – [25%(50% or 75%) x Mortgage Interest]*20%(finance cost tax reduction)

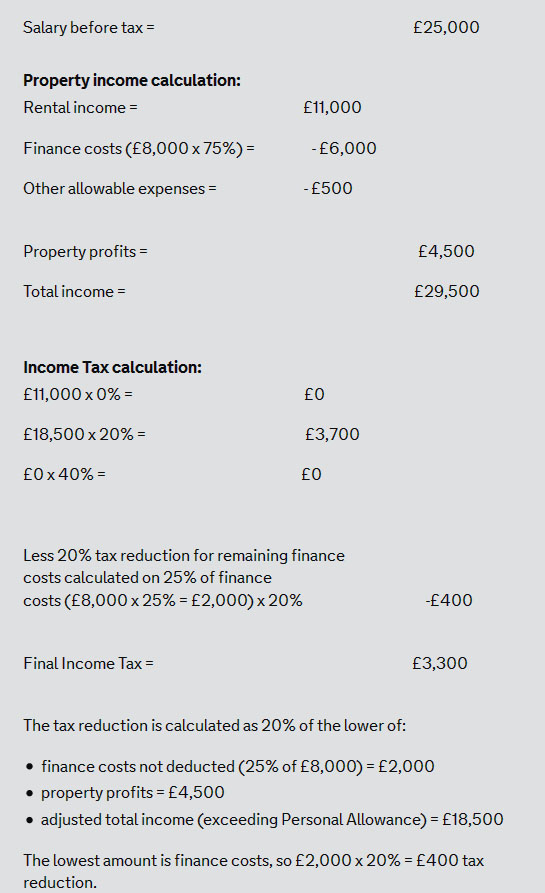

There is a case study presented by HMRC how the final tax income calculated in transition period between April 2017 and April 2020:

After April 2020

Landlords wouldn’t be allowed to deduct rental income on mortgage interest, BUT they would be able to apply 20% finance cost tax reduction calculated on property profits or on mortgage interest(lower figure must be chosen)

Income tax =

[(Rental income + Other landlord’s income) – (Allowable Expences) – Personal Allowance] *20%(for basic rate ratethreshold) + Income (for higher rate threshold)*40%

Final Income TAX = Income Tax – Mortgage Interest/Income profit * 20%

Picture below illustrates how landlord may claim financial cost deduction in case they are lower than profit income and when financial cost is higher than porfit income:

**check tax rate, threashold and income limit for Personal Allowance at HMRC